The global mergers and acquisitions (M&A) market is facing a significant deceleration as the era of cheap money firmly ends. The high cost of borrowing has triggered a widespread slowdown in deal activity, with lenders tightening credit requirements and buyers struggling to secure affordable financing.

Watch our short video on this topic HERE

The Credit Crunch

The primary driver of this lethargy is the elevated cost of capital. Higher interest rates have made borrowing significantly more expensive, directly impacting the feasibility of leveraged buyouts and strategic acquisitions. Lenders, wary of borrowers’ ability to service debt in this environment, have responded by imposing stricter credit requirements.

Banks are now conducting more exhaustive due diligence, demanding higher confidence in a target’s ability to repay loans before releasing funds. This increased scrutiny has not only reduced the approval rate for acquisition financing but has also lengthened the time required to close transactions, with many deals being put on hold indefinitely.

Buyers Facing Financing Headwinds

For potential acquirers, the landscape has become increasingly inhospitable. The elevated cost of debt has effectively shrunk the pool of qualified buyers, as many are priced out of the market or cannot meet the stringent terms set by financial institutions.

This creates a vicious cycle: as financing becomes less accessible, competition for assets decreases, shifting leverage away from sellers. Buyers who remain in the market are finding their purchasing power diminished, forcing them to negotiate harder or walk away from deals that would have been viable in a low-rate environment.

Valuation Compression

The impact of high rates extends beyond mere accessibility of funds; it is fundamentally reshaping business valuations. Higher interest rates drive up the discount rate used in financial models, which lowers the present value of future cash flows. Consequently, business valuations are facing downward pressure, leading to a “valuation gap” where sellers’ price expectations no longer align with what buyers can justify paying.

This compression has led to hesitation on the sell-side. Many business owners are delaying their exits, reluctant to sell at what they perceive as a discount, further contributing to the volume decline.

Structural Shifts: The Rise of Earn-Outs

To bridge the gap between cautious lenders and hopeful sellers, deal structures are evolving. There has been a resurgence in the use of “buyer-friendly” terms such as earn-outs and deferred payments.

With traditional debt financing harder to secure, buyers are increasingly asking sellers to share the risk. Earn-outs—where a portion of the purchase price is contingent on the business meeting future performance targets—are becoming essential tools to get deals across the line. While these mechanisms allow transactions to proceed, they often put sellers at a disadvantage, as they lose out on the time value of money, which is particularly punitive when interest rates are high.

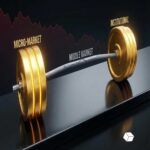

A “Barbell” Market Emerges

Despite the general slowdown, the market is not entirely frozen. A “barbell effect” is emerging, characterised by resilience at the extremes of the market. The lower middle market (£5M–£50M) continues to see activity from institutional investors seeking quality assets, while micro-businesses (sub-£500K) are seeing unexpected demand from individual buyers. However, for the broad middle of the market, the message from 2025 is clear: until borrowing costs ease, deal activity will remain constrained.